After divesting from Shell, the SNB divests from Chevron

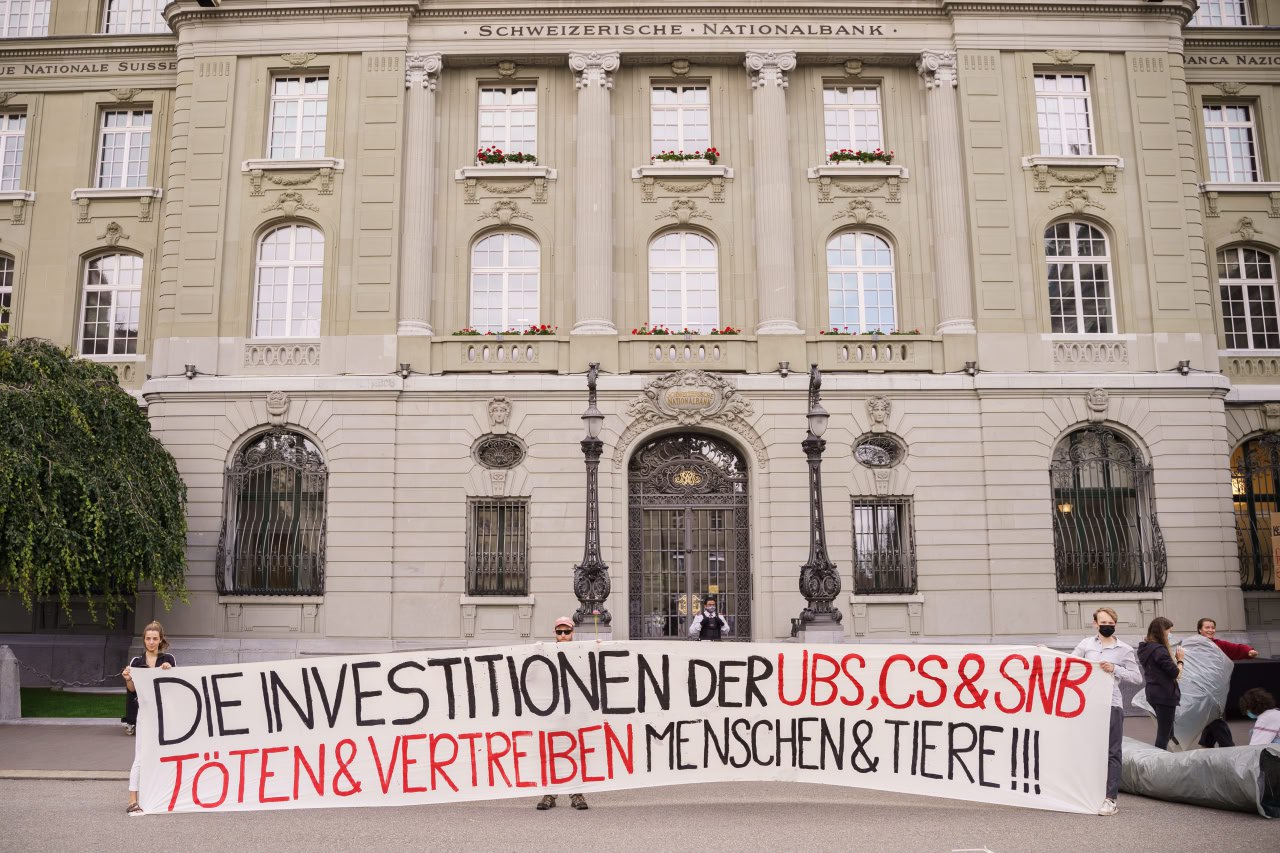

13 May 2025, Bern/Geneva, Switzerland – Following a long-standing campaign by the Coalition Our SNB, the Swiss National Bank has divested its investments in the multinational Chevron.

The Swiss climate justice movement and a Mapuche delegation had called on the bank to comply with its own guidelines by ceasing to invest in companies that cause major damage to the environment and human rights. The coalition is pleased to note the SNB’s decision to divest. However, It must now be coherent and exclude other companies which violate its investment guidelines from its portfolio, such as ExxonMobil and TotalEnergies.

More than two years ago, the Our SNB coalition published seven case studies showing how climate-damaging companies such as Chevron, TotalEnergies, etc. violate the SNB’s investment criteria. Last year, a delegation accompanied by a prominent representative of the Mapuche people, who are directly affected by the SNB’s investments in fossil fuels in Argentina, also spoke to SNB representatives about the consequences of their investments. This sale of Chevron shares worth USD 711.9 million shows that the SNB can divest from such climate-damaging companies, and should have done so long ago in accordance with its investment guidelines. After excluding thermal coal companies in 2020 and selling its Shell shares in the summer of 2023 (for USD 877 million), the SNB has taken another small step in the right direction. These decisions show that the SNB has the necessary instruments – including its multi-billion-dollar investment portfolio – to take the climate crisis into account.

Inconsistent exclusion practice: ExxonMobil and TotalEnergies must also be excluded

The SNB’s investment guidelines stipulate that companies that “seriously violate fundamental human rights or systematically cause serious damage to the environment” as well as “systematically poison water or landscapes or seriously harm biodiversity in the course of their production” must be excluded.

Eric Jondeau, professor of finance at the University of Lausanne (UNIL) and director of the Center for Risk Management, commented on the divestment from Shell: “If the SNB wants to, it can invest strategically—it chooses certain companies in its portfolio rather than passively following market indices.”

According to Guillaume Durin from BreakFree Suisse: “The SNB must respect its own rules. Divesting from Shell and Chevron, responsible for a series of fracking induced earthquakes in Argentina, while remaining invested in ExxonMobil, the world’s largest producer of plastic polymers dumped in our oceans, and in TotalEnergies, whose EACOP pipeline project in East Africa is linked to serious human rights violations, is incoherent. Let’s continue to mobilize.”

For years, the coalition has been calling for the SNB to align its investment policy and monetary policy with the Swiss Confederation’s climate and biodiversity goals. Lilian Schibli from Climate Alliance emphasizes: “In addition to excluding climate-damaging companies from its portfolio and exercising its shareholder rights for all other companies, the SNB should use other instruments: Differentiated key interest rates would help steer financial flows and create incentives for private banks to ensure that the financial and economic system supports the climate and biodiversity goals enshrined in law. ”

Climate risks threaten financial stability – the SNB must act

It is precisely because the SNB’s mandate is to ensure financial stability that it must address climate risks. “Scientific evidence shows that climate change, biodiversity loss and environmental degradation pose major risks to financial and price stability,” explains Carolin Carella, sustainable finance expert at WWF Switzerland. Ignoring these risks exposes the Swiss economy – and the SNB itself – to the destructive effects of climate change and biodiversity loss. Taking these risks seriously is therefore a prerequisite for the SNB to fulfill its mandate.